Design Splitwise into a complete settlement experience,

not just an expense tracker.

TL;DR

I helped launch Splitwise Pay and Card to let users settle up directly in-app, reduce manual expense tracking, and turn Splitwise from a bill tracker into a trusted fintech experience.

Overview

Splitwise had millions of people splitting rent, trips, dinners, and everything in between. But the moment it was time to actually settle up… users disappeared. They’d do the math in Splitwise, then jump to Venmo or their bank app to finish the job.

My work focused on launching Splitwise Pay and supporting Splitwise Card — new fintech products that helped users complete the full loop inside Splitwise, while unlocking a major new revenue stream for the business.

Where It All Began

Splitwise was already great at one thing: Tracking shared expenses. But tracking isn’t the hard part.

Paying is.

The “Settle Up” moment was the highest-intent action in the app… and also the biggest drop-off point. Users would hit “Settle Up,” see what they owed, and then think:

“Cool. Now I’ll go pay them somewhere else.”

That meant:

Lost engagement

Broken workflows

And a huge missed opportunity for Splitwise to become more than a calculator

The Core Problem

People trusted Splitwise with the numbers… but not yet with the money..

Moving real dollars introduces anxiety.

What if it fails?

What if it takes days?

Did it send?

Did they get it?

Now it’s serious.

So the challenge wasn’t just adding payments.

It was making payments feel safe, obvious, and effortless.

The Goal

Make settling up inside Splitwise not only possible…

…but preferable.

We wanted users to go from:

Expense → Balance → Payment → Resolution

All without leaving the app.

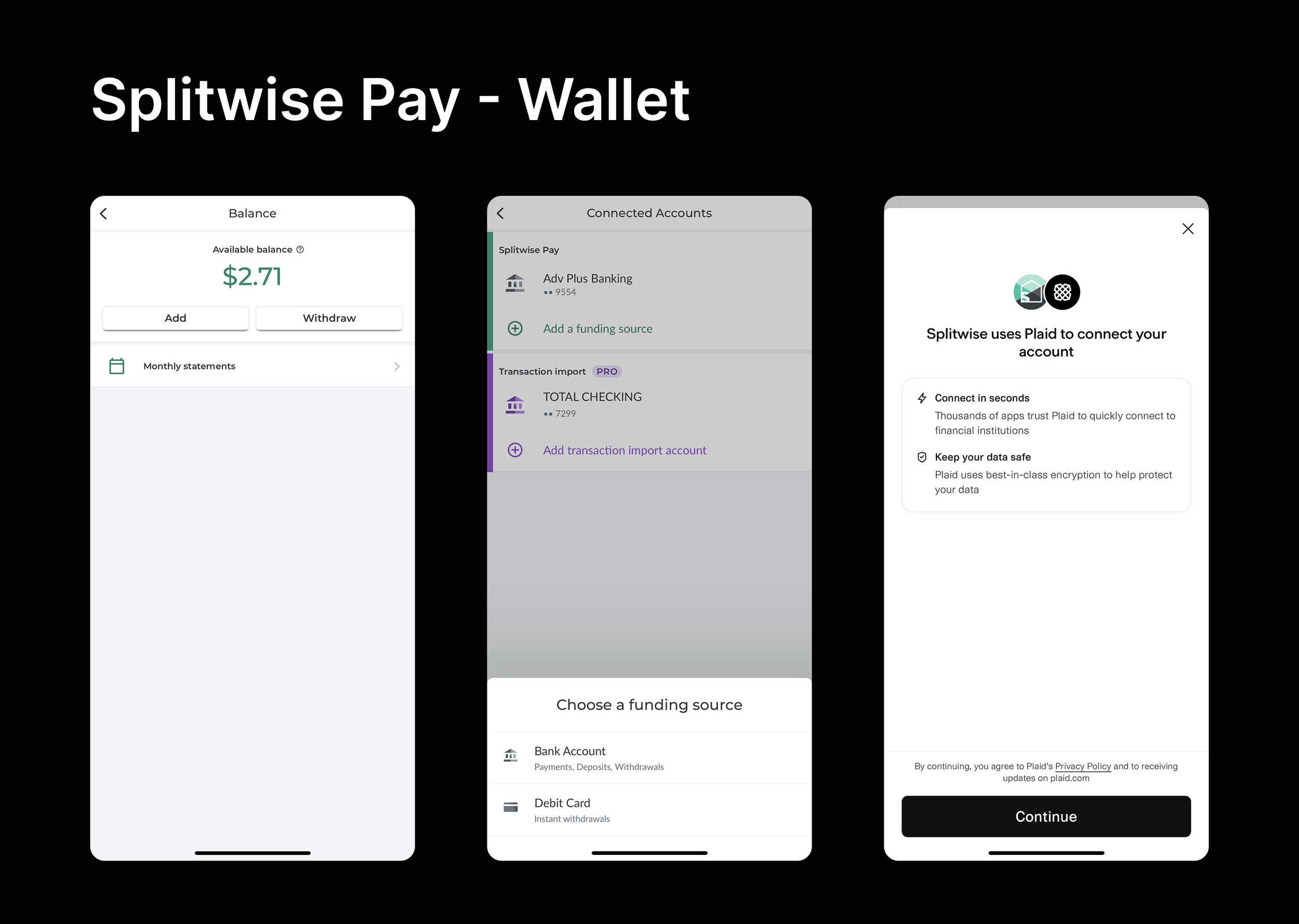

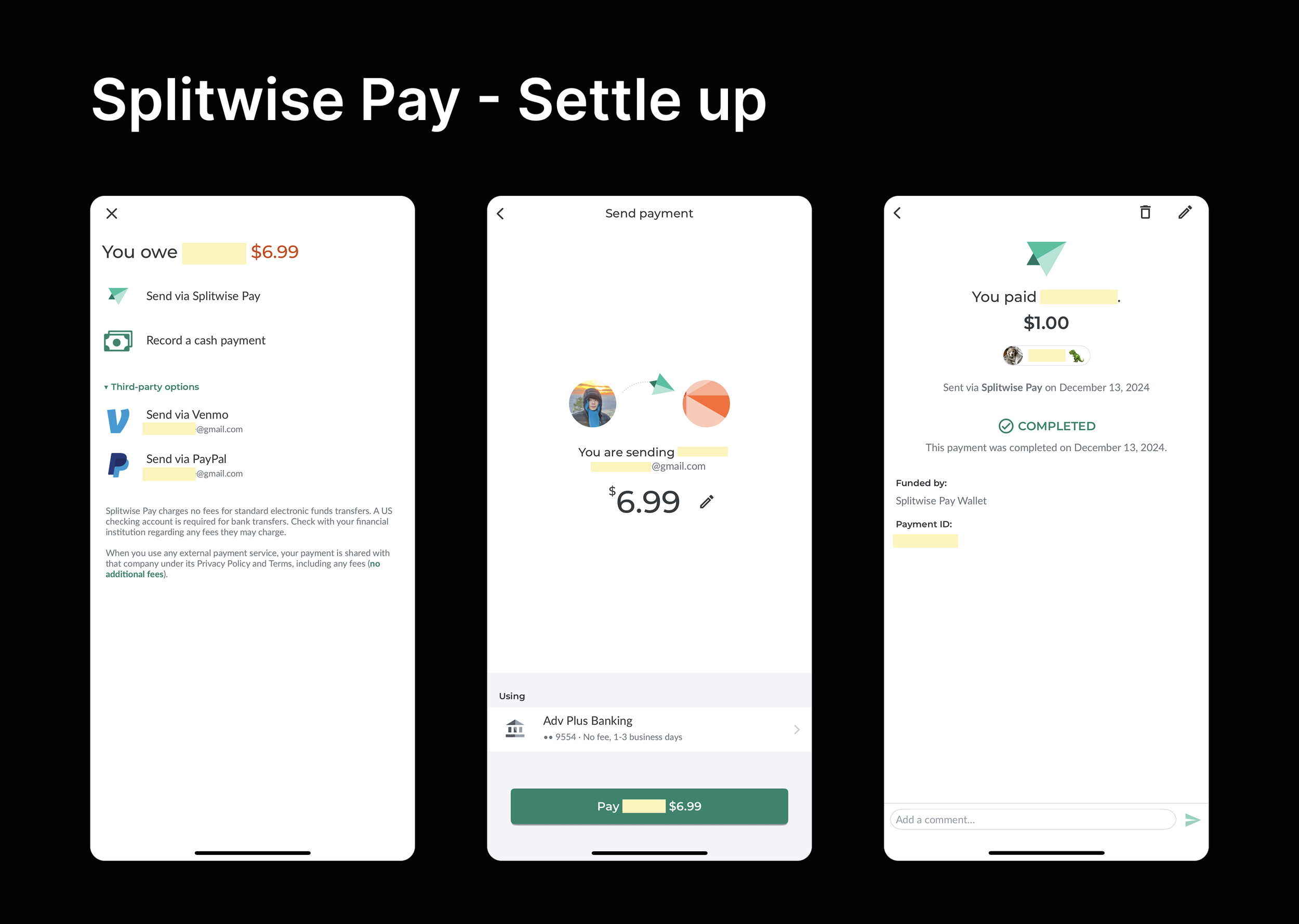

Splitwise Pay: Closing the Loop

We launched Splitwise’s first in-app peer-to-peer payment flow right inside the familiar “Settle Up” experience.

Sounds simple.

It wasn’t.

The first big challenge: Trust

Early prototypes worked functionally, but user reactions were cautious:

“Wait… is this actually sending money?”

“What happens next?”

“Did I just mess something up?”

So I focused heavily on confidence-building design:

Clear status indicators (“Pending,” “Completed,” “Failed”)

Confirmation moments that didn’t feel scary

Microcopy that explained what was happening in plain language

UI patterns that matched familiar fintech behavior

Payments needed to feel boring in the best way.

The second challenge: Edge cases everywhere

Expense splitting is neat.

Banking is not.

We had to design around:

Partial payments

ACH delays

Transaction failures

Linked account issues

I partnered early with engineering and compliance to map out the messy reality behind the scenes and make sure the UX didn’t fall apart when things went wrong.

Instead of dead ends, we designed retries, support pathways, and predictable next steps.

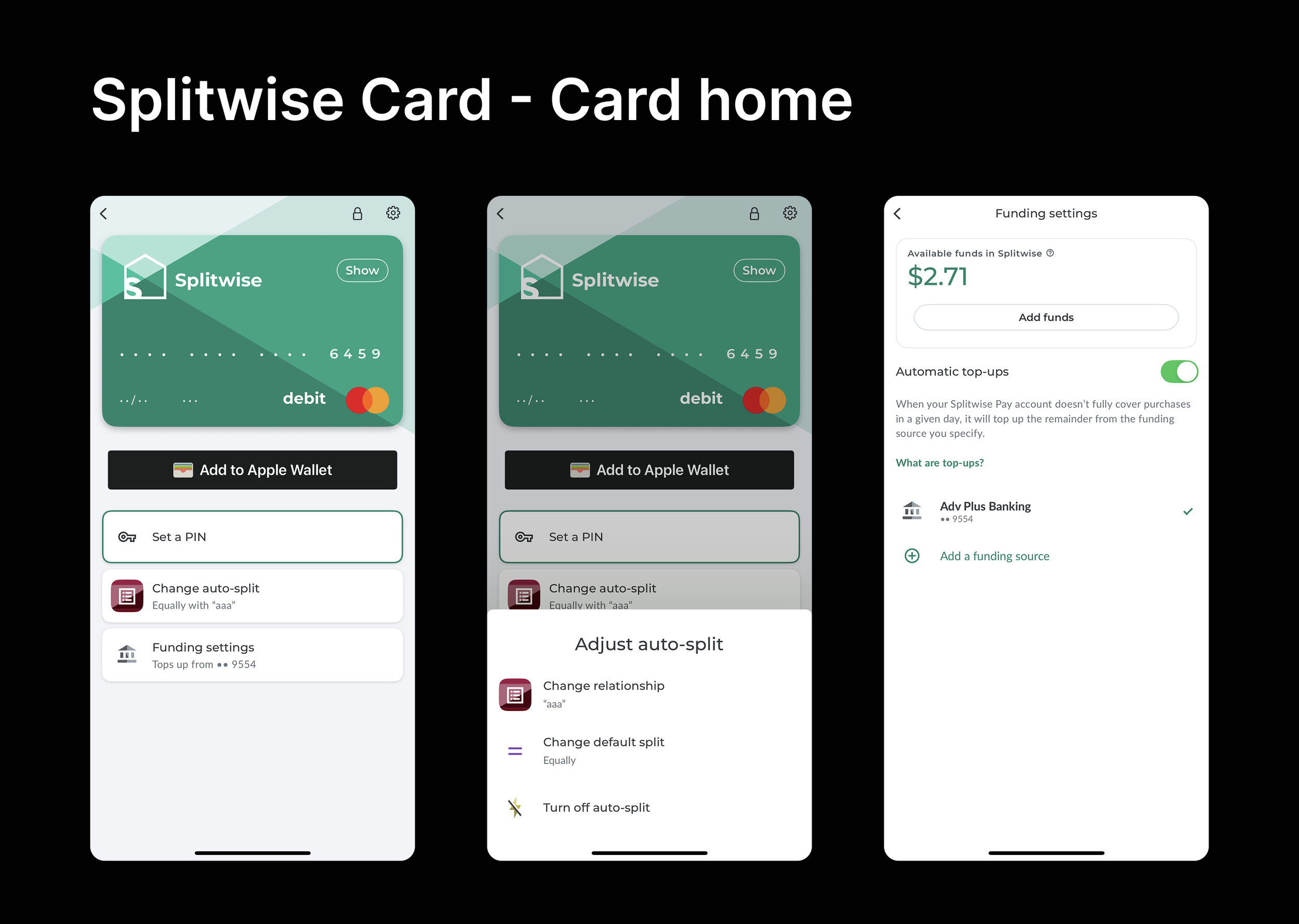

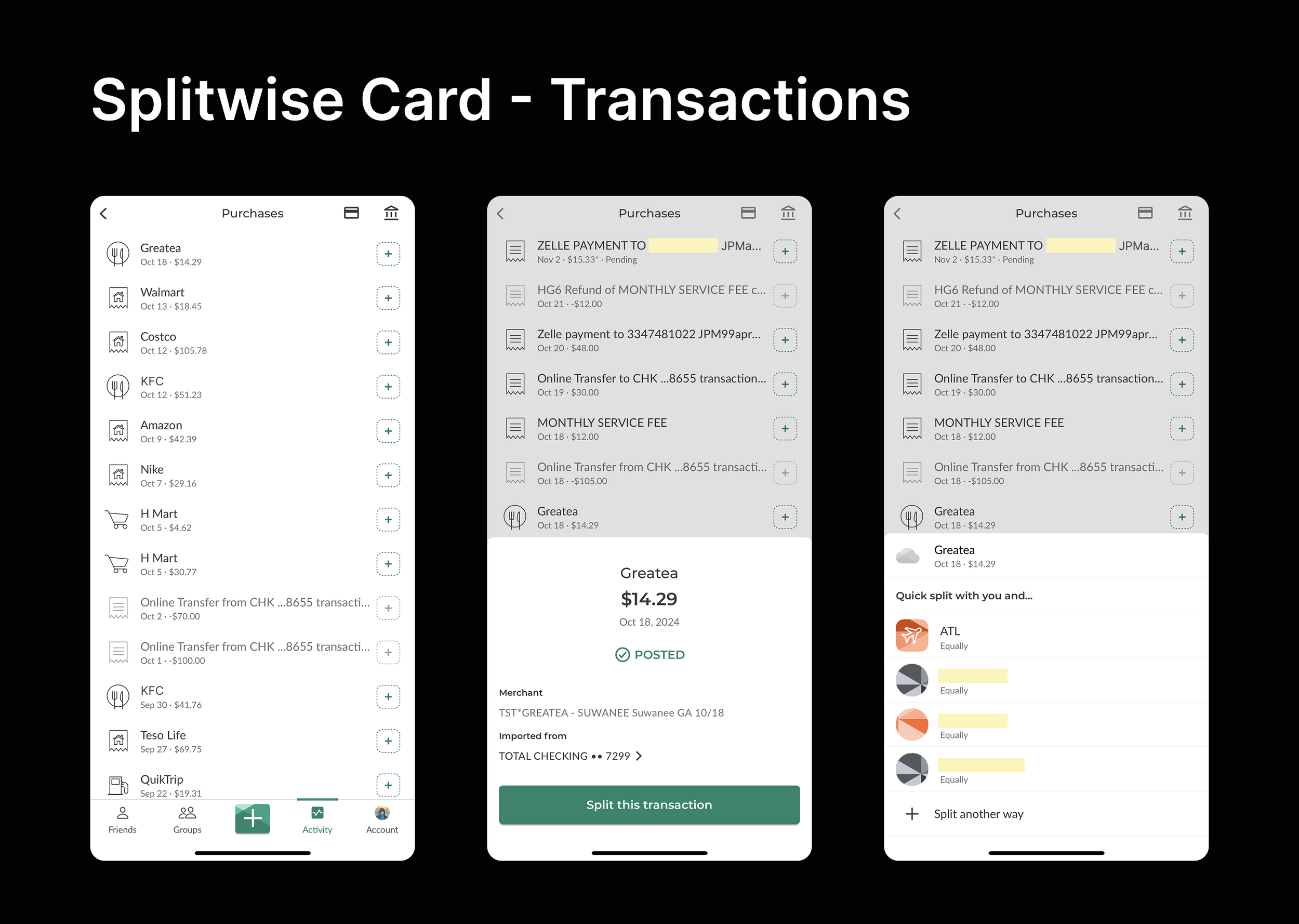

Splitwise Card: Making Expenses Automatic

Once Splitwise Pay proved users were willing to settle inside Splitwise, the next question was:

What if they didn’t have to log expenses at all?

Splitwise Card was a debit card that automatically split shared purchases.

My work centered on:

Integrating card management into the app without clutter

Designing onboarding that communicated the core value immediately

Adding lightweight education so the feature felt magical, not confusing

Instead of entering expenses while you are out… Splitwise handled it in real time.

How We Measured Success

Success wasn’t just revenue.

It was whether users actually finished what they came to do.

We tracked metrics like:

Conversion from “Settle Up” → Payment

Drop-off reduction during settlement

Payment completion without support tickets

Users resolving balances fully inside Splitwise

From a UX lens, the win was simple:

Fewer loose ends.

More closure.

More trust.

Impact

Splitwise Pay gave users a reason to stay in the app through the most important moment, turning Splitwise into a true financial tool, not just a tracker.

And Splitwise Card extended that vision into everyday spending, reducing manual effort and making shared expenses feel effortless.

Together, these launches helped prove that Splitwise could build fintech products users didn’t just understand…

…but actually adopted.